Top 10 African Startups with Female Founders That Raised Capital in 2025

Women entrepreneurs across Africa are steadily breaking barriers, building companies that address some of the continent’s most pressing challenges, from access to finance and clean energy to sustainable fashion and mobility.

However, funding for female-led startups in Africa remains one of the most persistent gaps in the venture capital landscape. Despite women making up nearly half of Africa’s entrepreneurs, women-only founding teams receive less than 5% of total disclosed funding across the continent. Mixed-gender founding teams capture a slightly larger share, but the imbalance remains stark when compared to male-only teams, which continue to attract the overwhelming bulk of investment.

That said, 2025 has its own bright spots. Several startups with women in leadership, whether as sole founders, co-founders, or CEOs, have closed notable rounds, signaling increased recognition of the value that women bring to Africa’s startup ecosystem and growing investor confidence in diverse leadership.

It is worth noting that within this list of 10 standout raises, only two are fully female-led ventures. The majority involve women as co-founders or CEOs within mixed leadership teams, a fact that underscores just how rare female-only leadership remains in the African funding landscape.

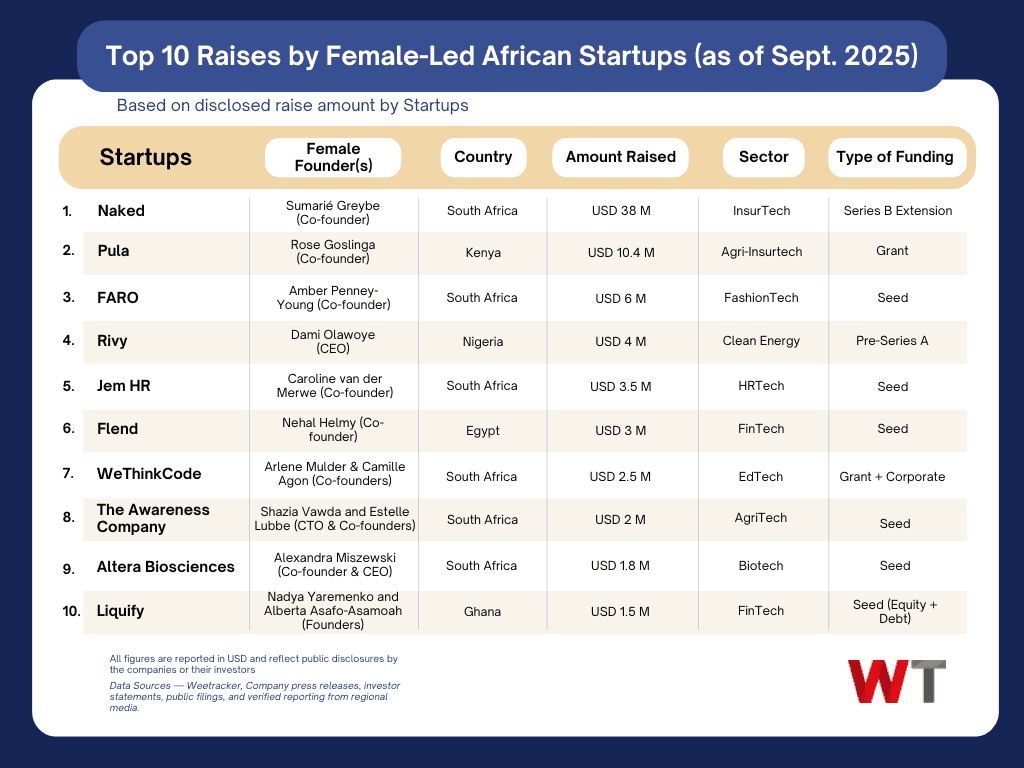

Here are 10 of the most notable raises from African female founders and CEOs.

1. Sumarié Greybe (Co-founder, Naked) – USD 38 M Series B Extension

Co-founded by Sumarié Greybe (alongside Alex Thomson and Ernest North), Naked has become a trailblazer in Africa’s insurtech sector. Its app-first platform allows customers to buy and manage insurance entirely online, from cars to homes, with quotes generated in under 90 seconds.

In January 2025, the company raised a USD 38 M Series B extension led by BlueOrchard, accompanied by returning backers IFC, DEG, Hollard, and Yellowwoods. This represented the largest insurtech financing across Africa to date.

Naked’s innovative “Naked Difference” model reinvests surplus premiums into customer-selected charities, making insurance more transparent and socially responsible. The funding was earmarked for product innovation, regulatory compliance, and regional expansion, setting Naked on the path to becoming a pan-African insurance leader.

2. Rose Goslinga (Co-founder, Pula) – EUR 10 M (~USD 10.4 M) Grant

Agriculture insurtech Pula, co-founded by Rose Goslinga in 2015, is tackling one of Africa’s toughest challenges: helping smallholder farmers withstand climate shocks. The startup designs scalable, data-driven insurance products that protect farmers from droughts, floods, and other climate risks.

A EUR 10 M (~USD 10.4 M) grant from the Bayer Foundation was an important boost that would enable Pula to insure 10 million farmers across Africa and Asia by 2030. This builds on past pilots that have already covered thousands of farmers in countries like Zimbabwe, Nigeria, and Kenya. By de-risking farming and enabling reinvestment in agriculture, Pula is positioning itself as a key player in ensuring global food security.

3. Amber Penney-Young (Co-founder, FARO) – USD 6 M Seed Round

Fashion waste is a global problem, and Amber Penney-Young, determined to tackle it in Africa, co-founded the startup in 2023 alongside male cofounders David Torr, Will McCarren, and Chris Makhanya. The South African startup sources, refurbishes, and resells surplus clothing, making fashion both affordable and sustainable.

In January, FARO announced that it had raised USD 6 M in a seed round, led by JP Zammitt, president of Bloomberg, with backing from Presight Capital, Gharage Ventures, and other high-profile investors. At the time, FARO had achieved USD 2.3 million in revenue across just four stores in South Africa, a sign of impressive early traction.

The funding was aimed at accelerating its ability to scale operations, combat textile waste, and make secondhand and refurbished fashion mainstream. It would also help FARO to scale operations, refine its use of AI for inventory management, and lay the foundations for reaching 1,000 stores across Africa, Asia, and Latin America over the next decade.

4. Dami Olawoye (CEO, Rivy) – USD 4 M Pre-Series A

Founded as Payhippo in 2019 by Chioma Okotcha, Uche Nnadi, and Zach Bijesse, the company rebranded to Rivy in March 2025 under CEO Dami Olawoye. Moving beyond SME lending, Rivy shifted focus toward clean energy financing, recognizing Nigeria’s unreliable electricity as a key obstacle for local businesses. It now provides solar financing solutions for SMEs and communities.

It’s USD 4 M pre-Series A round, comprising USD 2 M equity from EchoVC and Shell’s All On, plus USD 2 M in debt from local lenders. By that point, Rivy had already disbursed USD 2 million in clean energy loans in 2024, maintaining an impressive non-performing loan ratio under 1%.

The capital is expected to help Rivy to deepen relationships with solar vendors, expand its marketplace of over 250 solar vendors and installers, and support solar microgrid installations, thereby pushing forward Africa’s clean energy transformation.

With loan structures tailored to SMEs’ electricity needs and a low non-performing loan ratio, Rivy is emerging as a vital enabler of Africa’s energy transition.

5. Caroline van der Merwe (Co-founder, Jem HR) — USD 3.3M pre-Series A

Jem HR, originally launched as SmartWage, had evolved into a WhatsApp-first HR and benefits platform serving deskless and frontline workers who often lacked email or access to traditional HR systems.

The company, which counted Caroline van der Merwe among its co-founders alongside CEO Simon Ellis, announced a ZAR 60 M (about USD 3.3 M) pre-Series A in March 2025.

The round combined equity financing led by Next176 (an Old Mutual subsidiary) and a USD 1.65 M private debt facility designed to scale usage-based financial products for employees (e.g., on-demand pay, low-cost insurance and savings nudges).

Jem HR bet that the channel everyone already use, WhatsApp, could be made into a robust payroll, benefits and communications layer; the funding was earmarked to expand the product beyond Southern Africa and to build the financial rails for value-added services that improve frontline workers’ financial resilience.

6. Nehal Helmy (Co-founder, Flend) – USD 3 M Seed Round

Egypt’s SME sector faces significant financing gaps, and Nehal Helmy, co-founder of Flend, alongside Ahmed Zaki and Saif Edeen El Bendari, is building solutions to close them. The fintech startup operates Egypt’s first fully digital SME lending platform licensed by the Financial Regulatory Authority.

By embedding working capital finance directly into supply chains, logistics, and e-commerce platforms, Flend reduces loan approval times from months to just days.

In late July 2025, Flend announced that it had raised USD 3 M in seed funding (a blend of equity and debt), led by Egypt Ventures, with contributions from Camel Ventures, Sukna, Plus VC, Banque Misr, family offices, and MSMEDA. The capital was allocated to scale its embedded lending solution and inject over EGP 1 billion into Egypt’s SME ecosystem.

7. Arlene Mulder and Camille Agon (Co-founders, WeThinkCode) — USD 2 M grant from Google.org

WeThinkCode, co-founded by Arlene Mulder and Camille Agon (along with two male co-founders) and led operationally by CEO Nyari Samushonga, had been one of Africa’s best-known tuition-free coding academies.

In June 2025, Google.org awarded a USD 2 M (about ZAR 35 M) grant to expand WeThinkCode’s AI curriculum and scale training to 12,000 learners across South Africa and Kenya.

The grant was not a traditional equity round, but it represented a strategic, large-scale investment in talent infrastructure: the aim was to deliver practical AI training (40–80 hour modules), upskill non-technical professionals for AI adoption, and help close the region’s severe AI skills gap. For WeThinkCode, the funding was a lever to link free, aptitude-based tech training with corporate demand for skilled developers and AI-aware professionals.

8. Shazia Vawda and Estelle Lubbe (Co-founder & CTO, The Awareness Company) — USD 1.6 M seed

The Awareness Company (TACo) was co-founded by Shazia Vawda (CTO) and Estelle Lubbe (CXO) alongside male cofounder, Priaash Ramadeen, who is also currently CEO. The startup’s HYDRA product stitches AI, IoT, and analytics into a single operational platform that delivers insights for sustainability, asset optimisation, and climate reporting.

In mid-January 2025, the startup closed a USD 1.6 M seed round with backing from NEXT176, Holocene, Catalyst Fund, E Squared, Aions, and Jozi Angels.

The founders told investors the funds would accelerate HYDRA’s AI roadmap and expand sales and marketing into corporate customers (building use cases in energy, water, and smart-building management). Because TACo’s founding team mixes deep technical talent with product and domain specialists, investors framed the round as a bet on repeatable enterprise SaaS that drove both cost savings and measurable environmental outcomes.

9. Alexandra Miszewski (Co-founder & CEO, Altera Biosciences) — USD 1.6 M pre-seed

Altera Biosciences, co-founded by entrepreneur Alexandra Miszewski and Professor Michael Pepper, closed a ZAR 29 M (USD 1.6 M) pre-seed at the end of July 2025 to build a universal donor-cell platform. The company described ambitious, high-barrier work: gene-silencing approaches designed to strip immune identity markers from donor cells so that those cells could be used across patients without rejection.

The raise, led by OneBio Venture Studio and E Squared Investments with participation from specialist deep-tech backers, was one of the largest pre-seed rounds in South Africa’s nascent biotech space and signalled investor appetite for home-grown platforms that could play in global cell and gene therapy markets.

Altera’s funding was earmarked for lab R&D, establishing manufacturing partnerships, and recruiting translational scientists. Alexandra’s role as co-founder and CEO put a woman at the helm of one of Africa’s most technically ambitious startups to close funding in 2025.

10. Nadya Yaremenko and Alberta Asafo-Asamoah (Founders, Liquify) – USD 1.5 M Seed Round

Ghanian startup, Liquify, is co-founded by two women, Nadya Yaremenko (CEO) and Alberta Asafo-Asamoah, making it one of the few startups on this list led by an all-women founding team.

In a seed round announced around the end of June 2025, the company raised about USD 1.5 M (equity) with additional debt facilities; the round included participation from Future Africa, Launch Africa, and others.

Liquify’s product addressed a crushing problem for African exporters, waiting 30–90 days for invoice payment, by automating onboarding, KYC/AML, credit scoring, and settlement so verified export invoices could be bought and paid within hours.

The capital was intended to scale product, build structured investment vehicles for global yield-seeking investors, and expand into francophone markets to tackle one of the continent’s most costly trade finance gaps.

Bonus: Ameni Mansouri (CEO & Co-founder, Dabchy) – Seven-Figure Pre-Series A

Dabchy, co-founded by Ameni Mansouri together with Ghazi Ketata and Oussama Mahjoub, had become North Africa’s largest circular fashion marketplace by early 2025, with more than 1.3 million users in Tunisia and Egypt, and expansion plans into Egypt and the wider MENA region.

In February 2025, Dabchy announced a seven-figure (USD) pre-Series A led by Janngo Capital with participation from Renew Capital, Village Capital, and angel backers such as Karim Beguir.

The funds were allocated to logistics, product diversification, and ramping penetration into Egypt, where second-hand and recommerce markets were especially large. By digitising and scaling Tunisia’s vibrant apparel sector — which contributes 20% of the country’s GDP — Dabchy is unlocking both economic and environmental impact.

These stories underscore the growing influence of women in shaping Africa’s innovation economy. From building digital lending platforms and scaling circular fashion to advancing biotech and clean energy, female founders are proving that diverse leadership delivers both commercial and social impact.

If investor confidence in women-led ventures continues to strengthen, 2025 may be remembered for laying the foundation of a more inclusive startup ecosystem across the continent.

Source link